diff --git a/04 Research Environment/06 Indicators/02 Data Point Indicators/04 Create Indicator Timeseries.html b/04 Research Environment/06 Indicators/02 Data Point Indicators/04 Create Indicator Timeseries.html

deleted file mode 100644

index a7df26787e..0000000000

--- a/04 Research Environment/06 Indicators/02 Data Point Indicators/04 Create Indicator Timeseries.html

+++ /dev/null

@@ -1,120 +0,0 @@

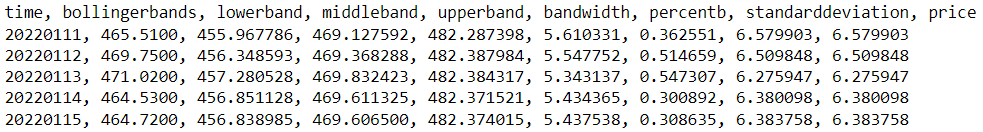

-You need to subscribe to some market data and create an indicator in order to calculate a timeseries of indicator values. In this example, use a 20-period 2-standard-deviation BollingerBands indicator.

-

-

var bb = new BollingerBands(20, 2);

-

bb = BollingerBands(20, 2)

-

You can create the indicator timeseries with the Indicator helper method or you can manually create the timeseries.

-

-Indicator Helper Method

-To create an indicator timeseries with the helper method, call the Indicator method.

-

-

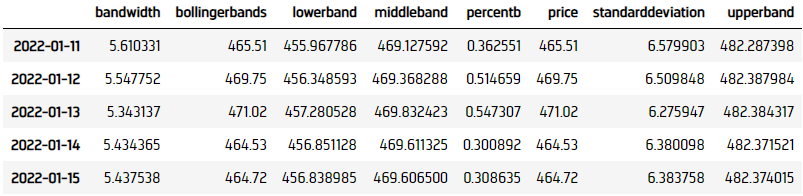

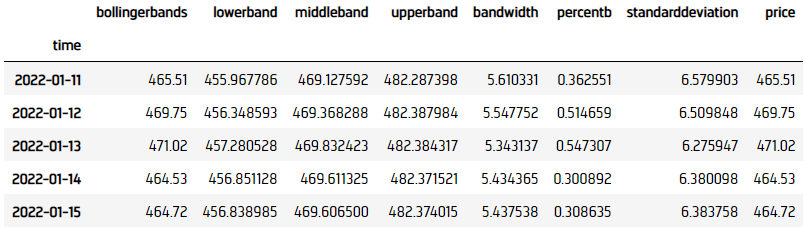

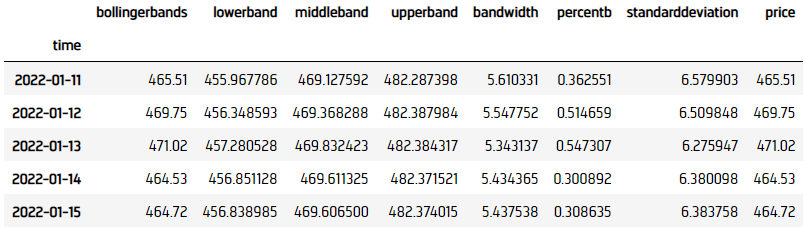

// Create a dataframe with a date index, and columns are indicator values.

-var bbIndicator = qb.Indicator(bb, symbol, 50, Resolution.Daily);

-

# Create a dataframe with a date index, and columns are indicator values.

-bb_dataframe = qb.indicator(bb, symbol, 50, Resolution.DAILY)

-

-

-

-

-

-

-Manually Create the Indicator Timeseries

-Follow these steps to manually create the indicator timeseries:

-

-

- - Get some historical data.

-

-

// Request historical trading data with the daily resolution.

-var history = qb.History(symbol, 70, Resolution.Daily);

-

# Request historical trading data with the daily resolution.

-history = qb.history[TradeBar](symbol, 70, Resolution.DAILY)

-

- Create a

RollingWindow for each attribute of the indicator to hold their values.

-

-

// Create a window dictionary to store RollingWindow objects.

-var window = new Dictionary<string, RollingWindow<decimal>>();

-// Store the RollingWindow objects, index by key is the property of the indicator.

-var time = new RollingWindow<DateTime>(50);

-window["bollingerbands"] = new RollingWindow<decimal>(50);

-window["lowerband"] = new RollingWindow<decimal>(50);

-window["middleband"] = new RollingWindow<decimal>(50);

-window["upperband"] = new RollingWindow<decimal>(50);

-window["bandwidth"] = new RollingWindow<decimal>(50);

-window["percentb"] = new RollingWindow<decimal>(50);

-window["standarddeviation"] = new RollingWindow<decimal>(50);

-window["price"] = new RollingWindow<decimal>(50);

-

-

# Create a window dictionary to store RollingWindow objects.

-window = {}

-# Store the RollingWindow objects, index by key is the property of the indicator.

-window['time'] = RollingWindow[DateTime](50)

-window["bollingerbands"] = RollingWindow[float](50)

-window["lowerband"] = RollingWindow[float](50)

-window["middleband"] = RollingWindow[float](50)

-window["upperband"] = RollingWindow[float](50)

-window["bandwidth"] = RollingWindow[float](50)

-window["percentb"] = RollingWindow[float](50)

-window["standarddeviation"] = RollingWindow[float](50)

-window["price"] = RollingWindow[float](50)

-

-

- Attach a handler method to the indicator that updates the

RollingWindow objects.

-

-

// Define an update function to add the indicator values to the RollingWindow object.

-bb.Updated += (sender, updated) =>

-{

- var indicator = (BollingerBands)sender;

- time.Add(updated.EndTime);

- window["bollingerbands"].Add(updated);

- window["lowerband"].Add(indicator.LowerBand);

- window["middleband"].Add(indicator.MiddleBand);

- window["upperband"].Add(indicator.UpperBand);

- window["bandwidth"].Add(indicator.BandWidth);

- window["percentb"].Add(indicator.PercentB);

- window["standarddeviation"].Add(indicator.StandardDeviation);

- window["price"].Add(indicator.Price);

-};

-

# Define an update function to add the indicator values to the RollingWindow object.

-def update_bollinger_band_window(sender: object, updated: IndicatorDataPoint) -> None:

- indicator = sender

- window['time'].add(updated.end_time)

- window["bollingerbands"].add(updated.value)

- window["lowerband"].add(indicator.lower_band.current.value)

- window["middleband"].add(indicator.middle_band.current.value)

- window["upperband"].add(indicator.upper_band.current.value)

- window["bandwidth"].add(indicator.band_width.current.value)

- window["percentb"].add(indicator.percent_b.current.value)

- window["standarddeviation"].add(indicator.standard_deviation.current.value)

- window["price"].add(indicator.price.current.value)

-

-bb.updated += UpdateBollingerBandWindow

-

When the indicator receives new data, the preceding handler method adds the new IndicatorDataPoint values into the respective RollingWindow.

-

- - Iterate through the historical market data and update the indicator.

-

-

foreach(var bar in history)

-{

- bb.Update(bar.EndTime, bar.Close);

-}

-

for bar in history:

- bb.update(bar.end_time, bar.close)

-

- Display the data.

-

-

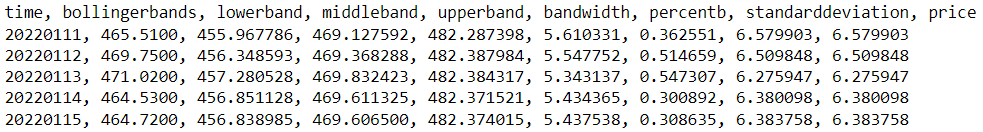

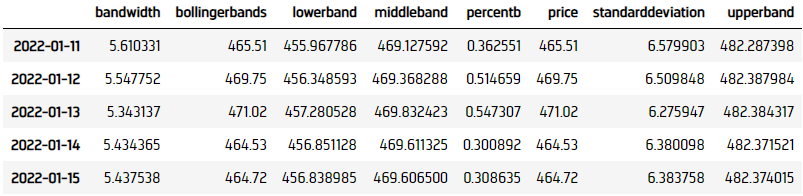

Console.WriteLine($"time,{string.Join(',', window.Select(kvp => kvp.Key))}");

-foreach (var i in Enumerable.Range(0, 5).Reverse())

-{

- var data = string.Join(", ", window.Select(kvp => Math.Round(kvp.Value[i],6)));

- Console.WriteLine($"{time[i]:yyyyMMdd}, {data}");

-}

-

-

-

-

- - Populate a

DataFrame with the data in the RollingWindow objects.

-

-

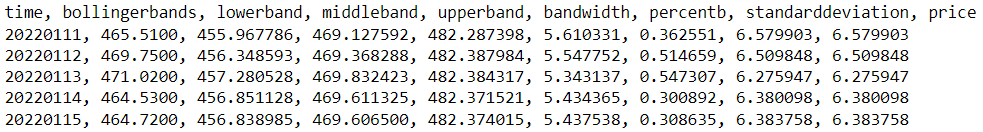

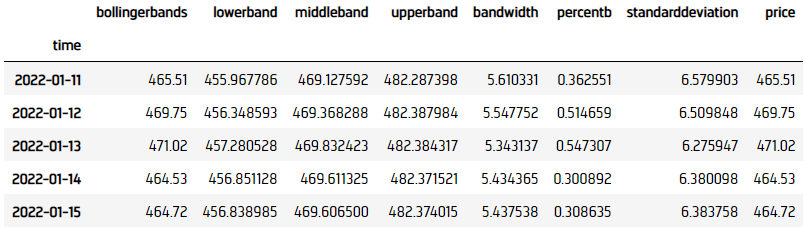

bb_dataframe = pd.DataFrame(window).set_index('time')

-

-

-

-

diff --git a/04 Research Environment/06 Indicators/02 Data Point Indicators/04 Create Indicator Timeseries.php b/04 Research Environment/06 Indicators/02 Data Point Indicators/04 Create Indicator Timeseries.php

new file mode 100644

index 0000000000..bd419e30ad

--- /dev/null

+++ b/04 Research Environment/06 Indicators/02 Data Point Indicators/04 Create Indicator Timeseries.php

@@ -0,0 +1,58 @@

+You need to subscribe to some market data and create an indicator in order to calculate a timeseries of indicator values. In this example, use a 20-period 2-standard-deviation BollingerBands indicator.

+

+

var bb = new BollingerBands(20, 2);

+

bb = BollingerBands(20, 2)

+

+

// Set the window.size to the desired timeseries length

+bb.Window.Size=50;

+bb.LowerBand.Window.Size=50;

+bb.MiddleBand.Window.Size=50;

+bb.UpperBand.Window.Size=50;

+bb.BandWidth.Window.Size=50;

+bb.PercentB.Window.Size=50;

+bb.StandardDeviation.Window.Size=50;

+bb.Price.Window.Size=50;

+

# Set the window.size to the desired timeseries length

+bb.window.size=50

+bb.lower_band.window.size=50

+bb.middle_band.window.size=50

+bb.upper_band.window.size=50

+bb.band_width.window.size=50

+bb.percent_b.window.size=50

+bb.standard_deviation.window.size=50

+bb.price.window.size=50

+

+

foreach (var i in Enumerable.Range(0, 5).Reverse())

+{

+ Console.WriteLine($"{bb[i].EndTime:yyyyMMdd} {bb[i].Value:f4} {bb.LowerBand[i].Value:f4} {bb.MiddleBand[i].Value:f4} {bb.UpperBand[i].Value:f4} {bb.BandWidth[i].Value:f4} {bb.PercentB[i].Value:f4} {bb.StandardDeviation[i].Value:f4} {bb.Price[i].Value:f4}");

+}

+

+

+ Populate a

+

+ Populate a DataFrame with the data in the Indicator object.

+

+

bb_dataframe = pd.DataFrame({

+ "current": pd.Series({x.end_time: x.value for x in bb}),

+ "lower_band": pd.Series({x.end_time: x.value for x in bb.lower_band}),

+ "middle_band": pd.Series({x.end_time: x.value for x in bb.middle_band}),

+ "upper_band": pd.Series({x.end_time: x.value for x in bb.upper_band}),

+ "band_width": pd.Series({x.end_time: x.value for x in bb.band_width}),

+ "percent_b": pd.Series({x.end_time: x.value for x in bb.percent_b}),

+ "standard_deviation": pd.Series({x.end_time: x.value for x in bb.standard_deviation}),

+ "price": pd.Series({x.end_time: x.value for x in bb.price})

+}).sort_index()

+

\ No newline at end of file

diff --git a/04 Research Environment/06 Indicators/03 Bar Indicators/04 Create Indicator Timeseries.html b/04 Research Environment/06 Indicators/03 Bar Indicators/04 Create Indicator Timeseries.html

deleted file mode 100644

index 82649f04d6..0000000000

--- a/04 Research Environment/06 Indicators/03 Bar Indicators/04 Create Indicator Timeseries.html

+++ /dev/null

@@ -1,96 +0,0 @@

-

\ No newline at end of file

diff --git a/04 Research Environment/06 Indicators/03 Bar Indicators/04 Create Indicator Timeseries.html b/04 Research Environment/06 Indicators/03 Bar Indicators/04 Create Indicator Timeseries.html

deleted file mode 100644

index 82649f04d6..0000000000

--- a/04 Research Environment/06 Indicators/03 Bar Indicators/04 Create Indicator Timeseries.html

+++ /dev/null

@@ -1,96 +0,0 @@

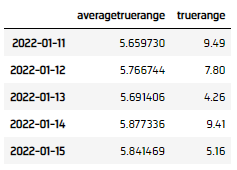

-You need to subscribe to some market data and create an indicator in order to calculate a timeseries of indicator values. In this example, use a 20-period AverageTrueRange indicator.

-

-

var atr = new AverageTrueRange(20);

-

atr = AverageTrueRange(20)

-

You can create the indicator timeseries with the Indicator helper method or you can manually create the timeseries.

-

-Indicator Helper Method

-To create an indicator timeseries with the helper method, call the Indicator method.

-

-

// Create a dataframe with a date index, and columns are ATR indicator values.

-var atrIndicator = qb.Indicator(atr, symbol, 50, Resolution.Daily);

-

# Create a dataframe with a date index, and columns are ATR indicator values.

-atr_dataframe = qb.indicator(atr, symbol, 50, Resolution.DAILY)

-

-

-

-

-

-

-

-

-Manually Create the Indicator Timeseries

-Follow these steps to manually create the indicator timeseries:

-

-

- - Get some historical data.

-

-

// Request historical trading data with the daily resolution.

-var history = qb.History(symbol, 70, Resolution.Daily);

-

# Request historical trading data with the daily resolution.

-history = qb.history[TradeBar](symbol, 70, Resolution.DAILY)

-

- Create a

RollingWindow for each attribute of the indicator to hold their values.

-

-

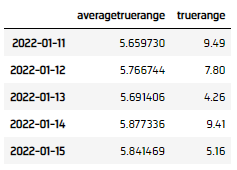

// Create a window dictionary to store RollingWindow objects.

-var window = new Dictionary<string, RollingWindow<decimal>>();

-// Store the RollingWindow objects, index by key is the property of the indicator.

-var time = new RollingWindow<DateTime>(50);

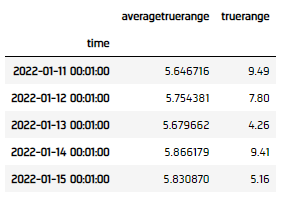

-window["averagetruerange"] = new RollingWindow<decimal>(50);

-window["truerange"] = new RollingWindow<decimal>(50);

-

-

# Create a window dictionary to store RollingWindow objects.

-window = {}

-# Store the RollingWindow objects, index by key is the property of the indicator.

-window['time'] = RollingWindow[DateTime](50)

-window['averagetruerange'] = RollingWindow[float](50)

-window["truerange"] = RollingWindow[float](50)

-

-

- Attach a handler method to the indicator that updates the

RollingWindow objects.

-

-

// Define an update function to add the indicator values to the RollingWindow object.

-atr.Updated += (sender, updated) =>

-{

- var indicator = (AverageTrueRange)sender;

- time.Add(updated.EndTime);

- window["averagetruerange"].Add(updated);

- window["truerange"].Add(indicator.TrueRange);

-};

-

# Define an update function to add the indicator values to the RollingWindow object.

-def update_average_true_range_window(sender: object, updated: IndicatorDataPoint) -> None:

- indicator = sender

- window['time'].add(updated.end_time)

- window["averagetruerange"].add(updated.value)

- window["truerange"].add(indicator.true_range.current.value)

-

-atr.updated += UpdateAverageTrueRangeWindow

-

When the indicator receives new data, the preceding handler method adds the new IndicatorDataPoint values into the respective RollingWindow.

-

- - Iterate through the historical market data and update the indicator.

-

-

foreach(var bar in history){

- // Update the indicators with the whole bar.

- atr.Update(bar);

-}

-

for bar in history:

- atr.update(bar)

-

- Display the data.

-

-

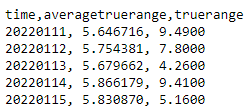

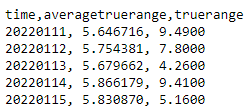

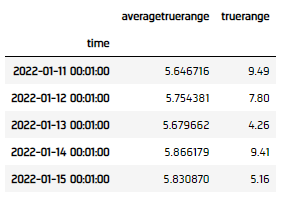

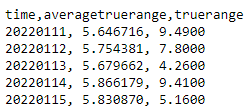

Console.WriteLine($"time,{string.Join(',', window.Select(kvp => kvp.Key))}");

-foreach (var i in Enumerable.Range(0, 5).Reverse())

-{

- var data = string.Join(", ", window.Select(kvp => Math.Round(kvp.Value[i],6)));

- Console.WriteLine($"{time[i]:yyyyMMdd}, {data}");

-}

-

-

-

-

- - Populate a

DataFrame with the data in the RollingWindow objects.

-

-

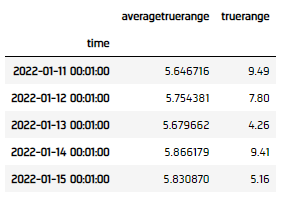

atr_dataframe = pd.DataFrame(window).set_index('time')

-

-

-

-

diff --git a/04 Research Environment/06 Indicators/03 Bar Indicators/04 Create Indicator Timeseries.php b/04 Research Environment/06 Indicators/03 Bar Indicators/04 Create Indicator Timeseries.php

new file mode 100644

index 0000000000..a74db7f1d9

--- /dev/null

+++ b/04 Research Environment/06 Indicators/03 Bar Indicators/04 Create Indicator Timeseries.php

@@ -0,0 +1,40 @@

+You need to subscribe to some market data and create an indicator in order to calculate a timeseries of indicator values. In this example, use a 20-period AverageTrueRange indicator.

+

+

var atr = new AverageTrueRange(20);

+

atr = AverageTrueRange(20)

+

+

// Set the window.size to the desired timeseries length

+atr.Window.Size = 50;

+atr.TrueRange.Window.Size = 50;

+

# Set the window.size to the desired timeseries length

+atr.window.size = 50

+atr.true_range.window.size = 50

+

+

foreach (var i in Enumerable.Range(0, 5).Reverse())

+{

+ Console.WriteLine($"{atr[i].EndTime:yyyyMMdd} {atr[i].Value:f4} {atr.TrueRange[i].Value:f4}");

+}

+

+

+ Populate a

+

+ Populate a DataFrame with the data in the Indicator object.

+

+

atr_dataframe = pd.DataFrame({

+ "current": pd.Series({x.end_time: x.value for x in atr}),

+ "truerange": pd.Series({x.end_time: x.value for x in atr.true_range})

+}).sort_index()

+

';

+include(DOCS_RESOURCES."/indicators/create-indicator-timeseries.php");

+?>

\ No newline at end of file

diff --git a/04 Research Environment/06 Indicators/04 Trade Bar Indicators/04 Create Indicator Timeseries.html b/04 Research Environment/06 Indicators/04 Trade Bar Indicators/04 Create Indicator Timeseries.html

deleted file mode 100644

index bba40d46af..0000000000

--- a/04 Research Environment/06 Indicators/04 Trade Bar Indicators/04 Create Indicator Timeseries.html

+++ /dev/null

@@ -1,91 +0,0 @@

-

';

+include(DOCS_RESOURCES."/indicators/create-indicator-timeseries.php");

+?>

\ No newline at end of file

diff --git a/04 Research Environment/06 Indicators/04 Trade Bar Indicators/04 Create Indicator Timeseries.html b/04 Research Environment/06 Indicators/04 Trade Bar Indicators/04 Create Indicator Timeseries.html

deleted file mode 100644

index bba40d46af..0000000000

--- a/04 Research Environment/06 Indicators/04 Trade Bar Indicators/04 Create Indicator Timeseries.html

+++ /dev/null

@@ -1,91 +0,0 @@

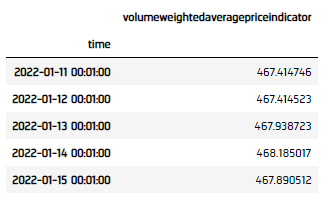

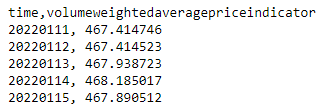

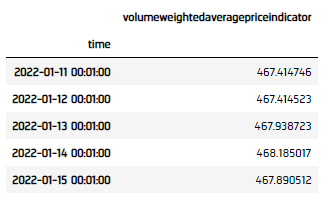

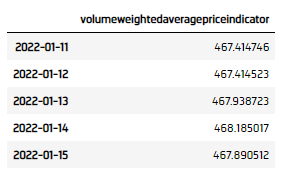

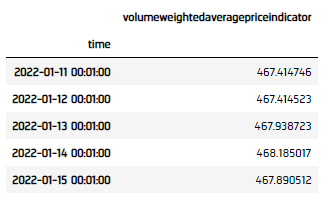

-You need to subscribe to some market data and create an indicator in order to calculate a timeseries of indicator values. In this example, use a 20-period VolumeWeightedAveragePriceIndicator indicator.

-

-

var vwap = new VolumeWeightedAveragePriceIndicator(20);

-

vwap = VolumeWeightedAveragePriceIndicator(20)

-

You can create the indicator timeseries with the Indicator helper method or you can manually create the timeseries.

-

-Indicator Helper Method

-To create an indicator timeseries with the helper method, call the Indicator method.

-

-

// Create a dataframe with a date index, and columns are indicator values.

-var vwapIndicator = qb.Indicator(vwap, symbol, 50, Resolution.Daily);

-

# Create a dataframe with a date index, and columns are indicator values.

-vwap_dataframe = qb.indicator(vwap, symbol, 50, Resolution.DAILY)

-

-

-

-

-

-

-Manually Create the Indicator Timeseries

-

-Follow these steps to create an indicator timeseries:

-

-

- - Get some historical data.

-

-

// Request historical trading data with the daily resolution.

-var history = qb.History(symbol, 70, Resolution.Daily);

-

# Request historical trading data with the daily resolution.

-history = qb.history[TradeBar](symbol, 70, Resolution.DAILY)

-

- Create a

RollingWindow for each attribute of the indicator to hold their values.

-

-

// Create a window dictionary to store RollingWindow objects.

-var window = new Dictionary<string, RollingWindow<decimal>>();

-// Store the RollingWindow objects, index by key is the property of the indicator.

-var time = new RollingWindow<DateTime>(50);

-window["volumeweightedaveragepriceindicator"] = new RollingWindow<decimal>(50);

-

-

# Create a window dictionary to store RollingWindow objects.

-window = {}

-# Store the RollingWindow objects, index by key is the property of the indicator.

-window['time'] = RollingWindow[DateTime](50)

-window['volumeweightedaveragepriceindicator'] = RollingWindow[float](50)

-

-

- Attach a handler method to the indicator that updates the

RollingWindow objects.

-

-

// Define an update function to add the indicator values to the RollingWindow object.

-vwap.Updated += (sender, updated) =>

-{

- time.Add(updated.EndTime);

- window["volumeweightedaveragepriceindicator"].Add(updated);

-};

-

# Define an update function to add the indicator values to the RollingWindow object.

-def update_vwap_window(sender: object, updated: IndicatorDataPoint) -> None:

- window['time'].add(updated.end_time)

- window["volumeweightedaveragepriceindicator"].add(updated.value)

-

-vwap.updated += UpdateVWAPWindow

-

When the indicator receives new data, the preceding handler method adds the new IndicatorDataPoint values into the respective RollingWindow.

-

-

- - Iterate through the historical market data and update the indicator.

-

-

foreach(var bar in history){

- // Update the indicators with the whole TradeBar.

- vwap.Update(bar);

-}

-

for bar in history:

- vwap.update(bar)

-

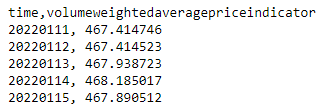

- Display the data.

-

-

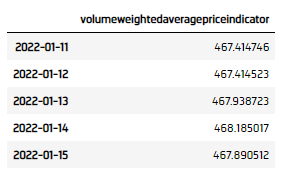

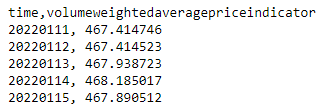

Console.WriteLine($"time,{string.Join(',', window.Select(kvp => kvp.Key))}");

-foreach (var i in Enumerable.Range(0, 5).Reverse())

-{

- var data = string.Join(", ", window.Select(kvp => Math.Round(kvp.Value[i],6)));

- Console.WriteLine($"{time[i]:yyyyMMdd}, {data}");

-}

-

-

-

-

- - Populate a

DataFrame with the data in the RollingWindow objects.

-

-

vwap_dataframe = pd.DataFrame(window).set_index('time')

-

-

-

-

diff --git a/04 Research Environment/06 Indicators/04 Trade Bar Indicators/04 Create Indicator Timeseries.php b/04 Research Environment/06 Indicators/04 Trade Bar Indicators/04 Create Indicator Timeseries.php

new file mode 100644

index 0000000000..cc4e555263

--- /dev/null

+++ b/04 Research Environment/06 Indicators/04 Trade Bar Indicators/04 Create Indicator Timeseries.php

@@ -0,0 +1,37 @@

+You need to subscribe to some market data and create an indicator in order to calculate a timeseries of indicator values. In this example, use a 20-period VolumeWeightedAveragePriceIndicator indicator.

+

+

var vwap = new VolumeWeightedAveragePriceIndicator(20);

+

vwap = VolumeWeightedAveragePriceIndicator(20)

+

+

// Set the window.size to the desired timeseries length

+vwap.Window.Size = 50;

+

# Set the window.size to the desired timeseries length

+vwap.window.size = 50

+

+

foreach (var i in Enumerable.Range(0, 5).Reverse())

+{

+ Console.WriteLine($"{vwap[i].EndTime:yyyyMMdd} {vwap[i].Value:f4}");

+}

+

+

+ Populate a

+

+ Populate a DataFrame with the data in the Indicator object.

+

+

vwap_dataframe = pd.DataFrame({

+ "current": pd.Series({x.end_time: x.value for x in vwap}))

+}).sort_index()

+

';

+include(DOCS_RESOURCES."/indicators/create-indicator-timeseries.php");

+?>

\ No newline at end of file

diff --git a/Resources/indicators/create-indicator-timeseries.php b/Resources/indicators/create-indicator-timeseries.php

new file mode 100644

index 0000000000..1a2ca637db

--- /dev/null

+++ b/Resources/indicators/create-indicator-timeseries.php

@@ -0,0 +1,38 @@

+

';

+include(DOCS_RESOURCES."/indicators/create-indicator-timeseries.php");

+?>

\ No newline at end of file

diff --git a/Resources/indicators/create-indicator-timeseries.php b/Resources/indicators/create-indicator-timeseries.php

new file mode 100644

index 0000000000..1a2ca637db

--- /dev/null

+++ b/Resources/indicators/create-indicator-timeseries.php

@@ -0,0 +1,38 @@

+You can create the indicator timeseries with the Indicator helper method or you can manually create the timeseries.

+

+Indicator Helper Method

+To create an indicator timeseries with the helper method, call the Indicator method.

+

+

// Create a dataframe with a date index, and columns are indicator values.

+var Indicator = qb.Indicator(, symbol, 50, Resolution.Daily);

+

# Create a dataframe with a date index, and columns are indicator values.

+_dataframe = qb.indicator(, symbol, 50, Resolution.DAILY)

+

Manually Create the Indicator Timeseries

+Follow these steps to manually create the indicator timeseries:

+

+

+ - Get some historical data.

+

+

// Request historical trading data with the daily resolution.

+var history = qb.History(symbol, 70, Resolution.Daily);

+

# Request historical trading data with the daily resolution.

+history = qb.history[TradeBar](symbol, 70, Resolution.DAILY)

+

- Set the indicator

Window.Sizewindow.size for each attribute of the indicator to hold their values.

+

+

+ - Iterate through the historical market data and update the indicator.

+

+

foreach (var bar in history)

+{

+ .Update();

+}

+

for bar in history:

+ .update()

+

\ No newline at end of file

-

-

-

-  -

- -

-

-

-

-

- -

-

-

-

-

-

-

- -

-

-

-  -

- -

-

-

-

-

- -

-

-

-  -

-