+

+

#load "../Initialize.csx"+

-

- #r "../Plotly.NET.dll"+

#load "../QuantConnect.csx" +#r "../Plotly.NET.dll" +#r "../Plotly.NET.Interactive.dll"

Plotly.NET and Plotly.NET.LayoutObjects packages.QuantConnect, Plotly.NET, and Accord packages.

-

+ using Plotly.NET; -using Plotly.NET.LayoutObjects;-

using QuantConnect; +using QuantConnect.Research; + +using Plotly.NET; +using Plotly.NET.Interactive; +using Plotly.NET.LayoutObjects; + +using Accord.Math; +using Accord.Statistics;+ \ No newline at end of file diff --git a/04 Research Environment/04 Charting/05 Plotly NET/04 Get Historical Data.php b/04 Research Environment/04 Charting/05 Plotly NET/04 Get Historical Data.php index 2eae83304b..2aec5f492b 100644 --- a/04 Research Environment/04 Charting/05 Plotly NET/04 Get Historical Data.php +++ b/04 Research Environment/04 Charting/05 Plotly NET/04 Get Historical Data.php @@ -9,7 +9,7 @@ "GS", // Goldman Sachs Group, Inc. "JPM", // J P Morgan Chase & Co "WFC" // Wells Fargo & Company -} +}; var symbols = tickers.Select(ticker => qb.AddEquity(ticker, Resolution.Daily).Symbol); var history = qb.History(symbols, new DateTime(2021, 1, 1), new DateTime(2022, 1, 1)); diff --git a/04 Research Environment/04 Charting/05 Plotly NET/10 Create Heat Map.html b/04 Research Environment/04 Charting/05 Plotly NET/10 Create Heat Map.html new file mode 100644 index 0000000000..61648de8ad --- /dev/null +++ b/04 Research Environment/04 Charting/05 Plotly NET/10 Create Heat Map.html @@ -0,0 +1,60 @@ +

You must import the plotting libraries and get some historical data to create heat maps.

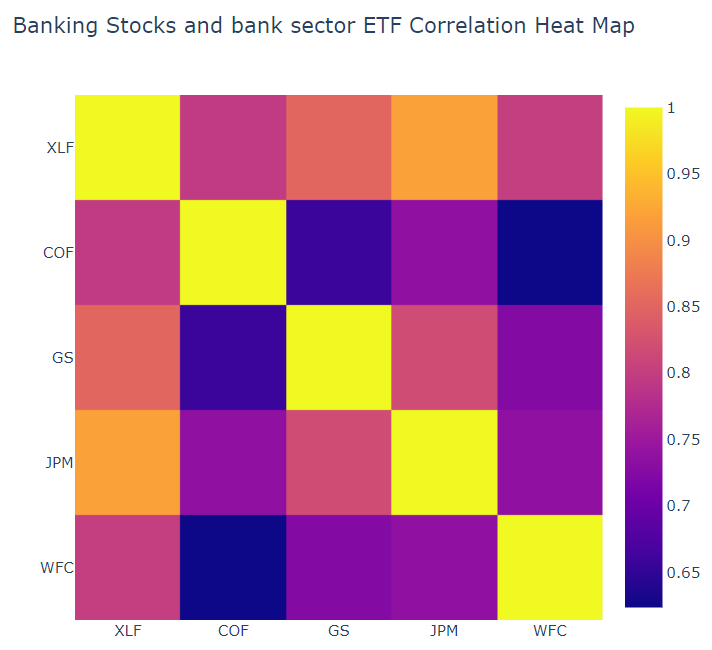

+ +In this example, you create a heat map that shows the correlation between the daily returns of the banking securities. Follow these steps to create the heat map:

+ +-

+

- Compute the daily returns. +

- Call the

Measures.Correlationmethod.

+ - Call the

Plotly.NET.Chart2D.Chart.Heatmapconstructor with the correlation matrix.

+ - Create a

Layout.

+ - Assign the

Layoutto the chart.

+ - Show the plot. +

+

+

+ var data = history.SelectMany(x => x.Bars.Values)

+ .GroupBy(x => x.Symbol)

+ .Select(x =>

+ {

+ var prices = x.Select(x => (double)x.Close).ToArray();

+ return Enumerable.Range(0, prices.Length - 1)

+ .Select(i => prices[i+1] / prices[i] - 1).ToArray();

+ }).ToArray().Transpose();

+

+

+

+ var corrMatrix = Measures.Correlation(data).Select(x => x.ToList()).ToList();+

+

+

+ var X = Enumerable.Range(0, tickers.Length).ToList(); + +var heatmap = Plotly.NET.Chart2D.Chart.Heatmap<IEnumerable<double>, double, int, int, string>( + zData: corr, + X: X, + Y: X, + ShowScale: true, + ReverseYAxis: true +);+

+

+

+ var axis = new LinearAxis();

+axis.SetValue("tickvals", X);

+axis.SetValue("ticktext", tickers);

+

+var layout = new Layout();

+layout.SetValue("xaxis", axis);

+layout.SetValue("yaxis", axis);

+layout.SetValue("title", Title.init("Banking Stocks and bank sector ETF Correlation Heat Map"));

+

+

+

+ heatmap.WithLayout(layout);+

+

+

+ HTML(GenericChart.toChartHTML(heatmap))+

The Jupyter Notebook displays the heat map.

+ +

+