A toolbox for connecting MATLAB to DTN IQFeed, to retrieve financial market data and news.

- Overview

- Main functionalities

- Additional program features

- Requirements

- Compatibility

- Installation

- Usage examples

- Disclaimer

- Contact us

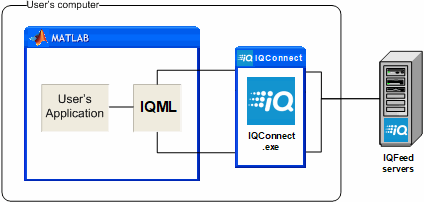

IQML is a Matlab connector to IQFeed, enabling users to leverage Matlab’s superior analysis and visualization capabilities, with IQFeed’s reliable data-feed of live and historic market data for stocks, ETFs, mutual funds, bonds, options, futures, commodities and Forex. IQML can be used for both automated algo-trading and selective manual trading, as well as continuous market data feed. IQML provides a reliable, easy-to-use Matlab interface to IQFeed that works right out of the box, and was optimized for excellent performance, reliability, stability and compatibility.

IQML includes a very detailed User Guide, complete with working usage examples and implementation tips.

This downloaded version is fully-functional and can run for 30 days for free. If you wish to use IQML beyond this time, you can purchase a license on IQML's webpage.

Simple Matlab commands fetch market data from IQFeed, in either blocking (snapshot) or non-blocking (streaming) modes:

- Live top-of-book market data (quotes and trades)

- Live Level2 market-depth data

- Historic, intra-day and live market data (individual ticks or interval bars)

- Fundamental info on assets

- Market scanner based on fundamental and trading criteria

- Options and futures chains lookup (with market data, Greeks)

- Symbols and market codes lookup

- News headlines, story-counts and complete news stories, with user-specified filters

- Connection stats and programmatic connect/disconnect

- Ability to attach user-defined Matlab callback functions to IQFeed messages and market events

- User-defined custom alerts on streaming market events (news/quotes/interval-bar/regional triggers)

- Combine all of the above for a full-fledged end-to-end automated trading system using plain Matlab

- Full solution – IQML provides easy-to-use access to IQFeed’s entire data-set within Matlab. Only the core Matlab and IQFeed’s client app are required – no additional toolbox or component is required.

- Stability – IQML has been extensively tested. It is rock solid.

- Easy to use – Users can access IQFeed’s data by simple Matlab commands, without need for any Matlab programming. IQML simplifies the IQFeed API in a very easy-to-use yet powerful interface that can be used by any Matlab user, novice or advanced.

- Novice and advanced users – Users can use easy-to-use Matlab commands, to access IQFeed’s data. Minimal or no programming is required to access this data.

- Blocking and non-blocking (streaming) modes – Users can receive IQFeed data both synchronously (waiting for data to arrive with optional timeout), and asynchronously (streaming data in the background).

- Settable market alerts – Users can define custom alerts on streaming news/quotes/interval-bars/regional-updates, which can be reported in various ways (popup window, console message, email, text (SMS) message, or Matlab callback function).

- User callbacks – Users can attach Matlab code (callbacks) to IQFeed messages. For example, this enables adding an entry in an Excel file, or sending an email, whenever a stock reaches a certain price or trade volume (also note the related alerts functionality).

- Security – IQML does not transmit any information externally except to IQFeed, so your trading information are as safe as your own computer.

- Performance – IQML is optimized for performance, providing fast and responsive connectivity. While Matlab as a platform is not well-suited for HFT, IQML enables receiving hundreds of streaming quotes or other IQFeed messages per second, with message latencies as low as 1ms and parallelization supported.

- Development – IQML was developed by an acknowledged Matlab expert, who wrote the reference textbooks on Matlab-Java connectivity and Matlab performance, as well as the acclaimed IB-Matlab connector (Matlab connector to Interactive Brokers). IQML is continuously improved and maintained.

- Support – Custom development and ongoing support is available directly from the developer, with extremely fast response times.

- Documentation – Extensive and comprehensive documentation, with numerous code examples and usage tips (see below).

- Backtesting – IQML does not include backtesting functionality. IQML’s author (Yair Altman) has extensive experience in developing complete backtesting and real-time trading applications. Yair will be happy to either develop a new application based on your specifications, or to integrate IQML into an existing application, under a consulting contract.

IQML is a Matlab connector to IQFeed, so it naturally needs the user to have both

- a locally-installed Matlab

- a locally-installed IQFeed client (IQConnect)

- an active IQFeed data account

- Platforms: IQML works on all platforms on which IQFeed runs: Windows, Mac OS, Linux.

- IQFeed: IQML works with all recent IQFeed installations, including the latest IQFeed API (6.1).

- Matlab: IQML works on all Matlab releases since 2008, including the latest release (R2019b).

- Download or clone IQML into a local folder on your computer (preferably a separate IQML folder)

- Add the local folder to your Matlab path using the path tool (in the Matlab Desktop’s toolstrip, click HOME / ENVIRONMENT / Set path… and save). The folder needs to be in your Matlab path whenever you run IQML.

- Ensure that your local IQFeed client is working and can be used to log-in to IQFeed. This client would be IQConnect.exe on Windows, IQFeed application on MacOS, or ran as a Windows app on Mac/Linux using Parallels/Wine.

- You can now run IQML within Matlab. To verify that IQML is properly installed, retrieve the latest IQFeed server time, as follows (see section 9.2 in the User Guide):

>> t = IQML('time');Additional usage examples are provided below.

This is a short sampling of IQML’s functionality. The product contains many more features and query types. Review the full IQML User Guide for a detailed description of the available functionality.

- Get market data (snapshot) for a security

- Get fundamental data for a security

- Get the latest interval bars for a security

- Calculate option Greeks, fair value and implied volatility

- Get historic/intra-day data

- Get streaming quotes data

- Get news data

- Get options/futures chains

- Connect/disconnect from IQFeed

- Get connection information/stats

- Specify message event callbacks

>> data = IQML('quotes', 'symbol','GOOG')

data =

Symbol: 'GOOG'

Most_Recent_Trade: 1092.14

Most_Recent_Trade_Size: 1

Most_Recent_Trade_Time: '09:46:31.960276'

Most_Recent_Trade_Market_Center: 25

Total_Volume: 113677

Bid: 1092.13

Bid_Size: 100

Ask: 1092.99

Ask_Size: 100

Open: 1099.22

High: 1099.22

Low: 1092.38

Close: 1090.93

Message_Contents: 'Cbaohlcv'

Message_Description: 'Last qualified trade; A bid update occurred, An ask update occurred; An open

declaration occurred; A high declaration occurred; A low declaration occurred;

A close declaration occurred; A volume update occurred'

Most_Recent_Trade_Conditions: '3D87'

Trade_Conditions_Description: 'Intramaket Sweep; Odd lot trade'

Most_Recent_Market_Name: 'Direct Edge A (EDGA)'Available parameters that affect the query: Symbols, Timeout, NumOfEvents, MsgParsingLevel, Fields, UseParallel.

>> data = IQML('fundamental', 'symbol','IBM')

data =

Exchange_ID: 7

PE: 25.7

Average_Volume: 4588000

x52_Week_High: 180.95

x52_Week_Low: 139.13

Calendar_Year_High: 171.13

Calendar_Year_Low: 144.395

Dividend_Yield: 3.79

Dividend_Amount: 1.5

Dividend_Rate: 6

Pay_Date: '03/10/2018'

Ex_dividend_Date: '02/08/2018'

Short_Interest: 17484332

Current_Year_EPS: 6.17

Next_Year_EPS: []

Five_year_Growth_Percentage: -0.16

Fiscal_Year_End: 12

Company_Name: 'INTERNATIONAL BUSINESS MACHINE'

Root_Option_Symbol: 'IBM'

Percent_Held_By_Institutions: 59.9

Beta: 1.05

Leaps: []

Current_Assets: 49735

Current_Liabilities: 37363

Balance_Sheet_Date: '12/31/2017'

Long_term_Debt: 39837

Common_Shares_Outstanding: 921168

Split_Factor_1: '0.50 05/27/1999'

Split_Factor_2: '0.50 05/28/1997'

Market_Center: []

Format_Code: 14

Precision: 4

SIC: 7373

Historical_Volatility: 25.79

Security_Type: 1

Listed_Market: 7

x52_Week_High_Date: '03/08/2017'

x52_Week_Low_Date: '08/21/2017'

Calendar_Year_High_Date: '01/18/2018'

Calendar_Year_Low_Date: '02/09/2018'

Year_End_Close: 153.42

Maturity_Date: []

Coupon_Rate: []

Expiration_Date: []

Strike_Price: []

NAICS: 541512

Exchange_Root: []

Option_Premium_Multiplier: []

Option_Multiple_Deliverable: []

Price_Format_Description: 'Four decimal places'

Exchange_Description: 'New York Stock Exchange (NYSE)'

Security_Type_Description: 'Equity'

SIC_Description: 'COMPUTER INTEGRATED SYSTEMS DESIGN'

NAICS_Description: 'Computer Systems Design Services'

SIC_Sector_Name: 'Services'

NAICS_Sector_Name: 'Professional, Scientific, Technical services'Available parameters that affect the query: Symbols, Timeout, MsgParsingLevel.

>> data = IQML('intervalbars', 'Symbol','@VX#', 'NumOfEvents',4)

data =

4×1 struct array with fields:

Symbol

BarType

Timestamp

Open

High

Low

Close

CummlativeVolume

IntervalVolume

NumberOfTrades

>> data(1)

ans =

Symbol: '@VX#'

BarType: 'Complete interval bar from history'

Timestamp: '2018-09-05 12:36:00'

Open: 14.45

High: 14.5

Low: 14.45

Close: 14.45

CummlativeVolume: 57077

IntervalVolume: 17

NumberOfTrades: 0Available parameters that affect the query: Symbols, Timeout, NumOfEvents, MaxItems, MaxDays, IntervalType, IntervalSize, BeginFilterTime, EndFilterTime, BeginDateTime, MsgParsingLevel.

>> data = IQML('greeks','symbol','IBM1814L116')

data =

Symbol: 'IBM1814L116'

Asset_Name: 'IBM DEC 2018 C 116.00'

Strike_Price: 116

Expiration_Date: '12/14/2018'

Days_To_Expiration: 30

Inferred_Asset_Side: 'Call'

Underlying_Symbol: 'IBM'

Underlying_Spot: 121.3

Underlying_Asset_Name: 'INTERNATIONAL BUSINESS MACHINE'

Underlying_Historic_Volatility: 37.1

Assumed_Risk_Free_Rate: 0

Assumed_Dividend_Yield: 0

Asset_Fair_Value: 8.1193

Asset_Latest_Price: 7.05

Asset_Price_Diff: 1.0693

Implied_Volatility: 0.28242

Delta: 0.68197

Vega: 0.12404

Theta: -0.076697

Rho: 6.1318

CRho: 6.7992

Omega: 10.189

Lambda: 10.189

Gamma: 0.027646

Vanna: -0.3527

Charm: 0.0021809

Vomma: 5.8043

Veta: 2.4262

Speed: -0.0012419

Zomma: -0.061581

Color: -0.00038078

Ultima: -45.238

Annual_Factor_Used: 365

This_Asset_Latest_Quote: [1×1 struct]

Underlying_Latest_Quote: [1×1 struct]

This_Asset_Fundamentals: [1×1 struct]

Underlying_Fundamentals: [1×1 struct]Available parameters that affect the query: Symbols, Timeout, UseParallel, UnderlyingSymbol, HistoricVolatility, RiskFreeRate, DividendsYield, Side, DaysToExpiration, DaysPerYear.

% Get historic daily data:

>> data = IQML('history', 'symbol','IBM', 'dataType','day') % dataType is optional (default: 'day')

data =

100×1 struct array with fields:

Symbol

Datestamp

Datenum

High

Low

Open

Close

PeriodVolume

OpenInterest

>> data(1)

ans =

Symbol: 'IBM'

Datestamp: '2017-10-10'

Datenum: 736978

High: 148.95

Low: 147.65

Open: 147.71

Close: 148.5

PeriodVolume: 4032601

OpenInterest: 0

>> highs = [data.High]; % array of High values

% Get historic ticks data for the VIX continuous future (@VX#):

>> data = IQML('history', 'symbol','@VX#', 'dataType','ticks');

>> data(1)

ans =

Symbol: '@VX#'

Timestamp: '2018-03-09 06:47:57.899000'

Datenum: 737128.283309016

Last: 17.12

LastSize: 1

TotalVolume: 3605

Bid: 17.1

Ask: 17.15

TickID: 4377589

BasisForLast: 'C'

TradeMarketCenter: 32

TradeConditions: '4D'

TradeAggressorCode: 0

DayOfMonth: 9

BasisDescription: 'Last qualified trade'

TradeMarketName: 'CBOE Futures Exchange (CFE)'

TradeDescription: 'Implied'

AggressorDescription: 'Unknown/unsupported'Available parameters that affect the query: Symbols, DataType (day/week/month/interval/ticks), DataDirection, MaxItems, Days, BeginDate, EndDate, BeginDateTime, EndDateTime, BeginFilterTime, EndFilterTime, IntervalType, IntervalSize, Timeout, UseParallel, MsgParsingLevel.

The initial request to send streaming quotes for the VIX continuous future (@VX#):

IQML('quotes', 'Symbol','@VX#', 'NumOfEvents',100, 'MaxItems',10);Multiple symbols can be specified, as a cell-array or colon-delimited string:

IQML('quotes', 'NumOfEvents',100, 'Symbols','@VX#:GOOG:AAPL'); % alternative #1

IQML('quotes', 'NumOfEvents',100, 'Symbols',{'@VX#','GOOG','AAPL'}); % alternative #2Subsequent requests to retrieve the latest accumulated data for a symbol, return a data struct that looks like this:

>> data = IQML('quotes', 'Symbol','@VX#', 'NumOfEvents',-1)

data =

Command: 'w@VX#'

isActive: 1

EventsToProcess: 100

EventsProcessed: 43

LatestEventDatenum: 737128.637260451

LatestEventTimestamp: '20180309 15:17:39.303'

DataType: 'quotes and trades'

ProcessType: 'stream'

BufferSize: 10

Buffer: [10×1 struct]

LatestData: [1×1 struct]

>> data.LatestData

ans =

Symbol: '@VX#'

Most_Recent_Trade: 17.08

Most_Recent_Trade_Size: []

Most_Recent_Trade_Time: '08:06:20.716000'

Most_Recent_Trade_Market_Center: 32

Total_Volume: 4507

Bid: 17.05

Bid_Size: 63

Ask: 17.1

Ask_Size: 244

Open: 17.2

High: 17.35

Low: 17

Close: 17.23

Message_Contents: 'Cbasohlcv'

Message_Description: 'Last qualified trade; A bid update occurred; An ask update occurred; A settlement

occurred; An open declaration occurred; A high declaration occurred; A low

declaration occurred; A close declaration occurred; A volume update occurred'

Most_Recent_Trade_Conditions: '4D'

Trade_Conditions_Description: 'Implied'

Most_Recent_Market_Name: 'CBOE Futures Exchange (CFE)'Available parameters that affect the query: Symbols, DataType (quotes/trades), NumOfEvents, MaxItems, Timeout, Fields.

Similarly, streaming interval bars, regional updates and Level-2 market depth updates can be requested using IQML('intervalbars',...), IQML('regional',...) and IQML('marketdepth',...) commands.

News configuration:

>> data = IQML('news', 'DataType','config')

data =

Category: 'All News'

Majors: [1×7 struct]

>> {data.Majors.Description}

ans =

1×7 cell array

{'DTN News'} {'PR Newswire'} {'Business Wire'} {'Real-Time Trader'} {'GlobeNewswire Inc'} {'Marketwire'} {'Benzinga Pro'}

% This shows that we are connected to 7 major news sources. We can drill-down for details about these news sources:

>> data.Majors(1) % first of 7 Major news sources

ans =

Source: 'DTN'

Description: 'DTN News'

AuthenticationCode: '1D'

IconID: 10

Minors: [1×4 struct]

>> data.Majors(1).Minors(1) % 1st of 4 Minor DTN sources

ans =

Source: 'DT5'

Description: 'Treasuries, Most Actives, Gainers, Losers'

AuthenticationCode: '1D'

>> data.Majors(1).Minors(2) % 2nd of 4 Minor DTN sources

ans =

Source: 'RTL'

Description: 'Derivatives - Selected Futures and Options'

AuthenticationCode: '2Ab'

IconID: 10News story headlines:

>> data = IQML('news', 'DataType','headlines')

data =

1000×1 struct array with fields:

Source

ID

Symbols

Timestamp

Text

>> data(1)

ans =

Source: 'BEN'

ID: 21991162633

Symbols: {'BZRatings' 'MNTX'}

Timestamp: 20180305064533

Text: 'Manitex International Sees Q4 Sales $64.40M vs $64.45M Est...'

% Limiting the headlines to specific symbols, events and/or news-sources:

>> data = IQML('news', 'DataType','headlines', 'Symbols',{'IBM','GOOG','BZRatings'}, 'Sources',{'DTN','CPR','BEN'});

>> data = IQML('news', 'DataType','headlines', 'Symbols','IBM:GOOG:BZRatings', 'Sources','DTN:CPR:BEN'); % equivalent alternative

data =

687×1 struct array with fields:

Source

ID

...News story full text:

>> data = IQML('news', 'DataType','story', 'ID',21991162633)

data =

ID: 21991162633

Symbols: {'BZRatings' 'MNTX'}

Text: 'Manitex International Sees Q4 Sales $64.40M vs $64.45M Est.

Manitex International (NASDAQ: MNTX) sees Q4 sales of $64.40M vs $64.45M estimate.'

News story count:

>> data = IQML('news', 'DataType','number', 'Symbols','BSX:AAPL:GOOG')

data =

AAPL: 7

BSX: 14

GOOG: 2

% The query can be limited by symbol(s), news-source(s), and date(s):

>> data = IQML('news', 'DataType','number', 'Symbols','BSX:GOOG:AAPL', 'BeginDate',20180301, 'EndDate',20180303)

data =

AAPL: 37

BSX: 3

GOOG: 13Available parameters that affect the query: Symbols, Sources, DataType, Date, BeginDate, EndDate, MaxItems, GetStory, NumOfEvents, Timeout, UseParallel.

% Report GOOG options having strike price between $1000-$1010 in next 4 months

>> symbols = IQML('chain', 'symbol','goog', 'NearMonths',4, 'MinStrike',1000, 'MaxStrike',1010)'

symbols =

1×58 cell array

Columns 1 through 4

'GOOG1803H1000' 'GOOG1803H1010' 'GOOG1810H1000' 'GOOG1810H1005'

Columns 5 through 8

'GOOG1810H1010' 'GOOG1813G1000' 'GOOG1813G1002.5' 'GOOG1813G1005'

Columns 9 through 12

'GOOG1813G1007.5' 'GOOG1813G1010' 'GOOG1817H1000' 'GOOG1817H1005'

...

% Fetch the options chain for a symbol along with the latest quotes for all options

>> data = IQML('chain', 'symbol','GOOG', 'NearMonths',4, 'MinStrike',1000, 'MaxStrike',1010, 'WhatToShow','quotes')

data =

58×1 struct array with fields:

Symbol

Most_Recent_Trade

Most_Recent_Trade_Size

Most_Recent_Trade_Time

Most_Recent_Trade_Market_Center

Total_Volume

Bid

Bid_Size

Ask

Ask_Size

Open

High

Low

Close

...

>> data(1)

ans =

Symbol: 'GOOG1803H1000'

Most_Recent_Trade: 120

Most_Recent_Trade_Size: 1

Most_Recent_Trade_Time: '15:57:12.930497'

Most_Recent_Trade_Market_Center: 156

Total_Volume: 0

Bid: 140.5

Bid_Size: 3

Ask: 150.1

Ask_Size: 1

Open: []

High: []

Low: []

Close: 120

Message_Contents: 'Cbacv'

Message_Description: 'Last qualified trade; A bid update occurred;

An ask update occurred; A close declaration occurred; A volume update occurred'

Most_Recent_Trade_Conditions: 1

Trade_Conditions_Description: 'Normal Trade'

Most_Recent_Market_Name: 'MIAX PEARL Options exchange'

% Fetch the options chain for a symbol along with the fundamental data for all options

>> data = IQML('chain', 'symbol','GOOG', 'NearMonths',4, 'MinStrike',1000, 'MaxStrike',1010, 'WhatToShow','fundamental')

data =

58×1 struct array with fields:

Symbol

Exchange_ID

PE

Average_Volume

x52_Week_High

x52_Week_Low

Calendar_Year_High

Calendar_Year_Low

...Available parameters that affect the query: Symbols, DataType (options/futures/spread/foptions), Side, WhatToShow, Months, NearMonths, Years, IncludeBinary, MinStrike, MaxStrike, NumInMoney, NumOutOfMoney, UseParallel.

IQML('disconnect'); % disconnect from IQFeed (IQConnect)

IQML('reconnect'); % disconnect and then automatically re-connect (optional parameters: Username, Password)>> data = IQML('stats')

data =

ServerIP: '66.112.148.226'

ServerPort: 60002

MaxSymbols: 1300

NumOfStreamingSymbols: 0

NumOfClientsConnected: 3

SecondsSinceLastUpdate: 1

NumOfReconnections: 0

NumOfAttemptedReconnections: 0

StartTime: 'Mar 07 11:03AM'

MarketTime: 'Mar 07 04:34AM'

ConnectionStatus: 'Connected'

IQFeedVersion: '5.2.7.0'

LoginID: '123456-1'

TotalKBsRecv: 42.98

KBsRecvLastSecond: 0.02

AvgKBsPerSecRecv: 0.02

TotalKBsSent: 361.62

KBsSentLastSecond: 0.22

AvgKBsPerSecSent: 0.19

Exchanges: {1×16 cell}

ServerVersion: '6.0.0.5'

ServiceType: 'real_time'Additional port-specific stats can be requested using the optional AddPortStats parameter:

>> data = IQML('stats', 'AddPortStats',1)

data =

ServerIP: '66.112.148.224'

ServerPort: 60005

...

Level2: [1×1 struct]

Level2SymbolsWatched: 2

Lookup: [1×1 struct]

RegionalSymbolsWatched: 2

Admin: [1×1 struct]

Level1: [1×1 struct]

Level1SymbolsWatched: 0We can attach a user callback function to all IQFeed messages:

IQML('ProcessFunc',@IQML_Callback); % set a single callback function for all message typesWe can also specify specific callbacks for various message types, and a default callback for all other message types:

% Alternative #1: using the struct() function:

callbacks = struct('System', [], ... % ignore System messages

'Quote_update',@IQML_Quote_Update_Callback, ... % Level-1 quote updates

'Market_depth',@IQML_Market_Depth_Callback, ... % Level-2 market-depth updates

'Default', @IQML_Default_Callback); % default callback for all other messages

% Alternative #2: using direct field assignments:

callbacks.System = []; % ignore System messages

callbacks.Quote_update = @IQML_Quote_Update_Callback;

callbacks.Market_depth = @IQML_Market_Depth_Callback;

callbacks.Default = @IQML_Default_Callback);

% Now update IQML with these callbacks:

IQML('time', 'processFunc',callbacks);where the callback functions are defined similarly to the following (for example, in a file called IQML_Callback.m):

function IQML_Callback(iqObject, eventData, varargin)

% Extract the basic event data components

event_timestamp = eventData.Timestamp; % local time in Matlab's datenum format

event_msg_port = eventData.MessagePort; % e.g. 'Level2' for a Market_depth event

event_msg_type = eventData.MessageType; % e.g. 'Market_depth'

event_msg_header = eventData.MessageHeader; % e.g. 'Z' for a Market_depth event

event_msg_string = eventData.MessageString; % the complete message string from IQFeed

event_msg_parts = eventData.MessageParts; % the parsed message, split into a cell-array

% Now do something useful with all this information...

...

end % IQML_CallbackTHIS SOFTWARE IS PROVIDED “AS IS”, WITHOUT WARRANTY OF ANY KIND, EXPRESSED OR IMPLIED, INCLUDING BUT NOT LIMITED TO THE WARRANTIES OF MERCHANTABILITY, FITNESS FOR A PARTICULAR PURPOSE AND NON-INFRINGEMENT. IN NO EVENT SHALL THE AUTHORS OR COPYRIGHT HOLDERS BE LIABLE FOR ANY CLAIM, DAMAGES, LOSS OR OTHER LIABILITY, WHETHER IN AN ACTION OF CONTRACT OR OTHERWISE, ARISING FROM, OUT OF OR IN CONNECTION WITH THE SOFTWARE OR THE USE OR OTHER DEALINGS IN THE SOFTWARE.

(A detailed disclaimer is available in IQML’s User Guide, as well as in the separate DISCLAIMER file)

For additional information about IQML, please visit the product's webpage (http://IQML.net or https://undocumentedmatlab.com/IQML).

If you have any question or feedback, or need professional assistance in integrating IQML into your trading system, please email us ([email protected]) and we will be happy to help.